Total employment growth in Colorado in September continued to show slight growth statewide in the year-over-year comparisons. In September, total employment in Colorado was down 89,000 from the July 2008 peak. Employment trends in various regions of the state differ, however, so this article

looks at which regions of the state have the highest unemployment rates, and which regions have recovered the most in their labor markets.

Regional employment trends can also provide us with some insights into local housing demand since, all things being equal, those areas with the most robust labor demand will also have the strongest demand for housing. This would be reflected in apartment vacancy rates and in median home price and home sales transactions, among other indicators.

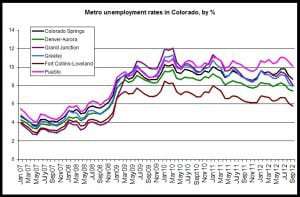

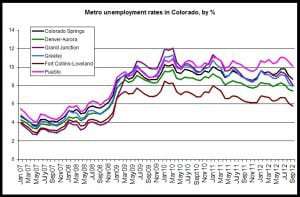

The first graph compares unemployment rates in Colorado's metro areas.

The regional unemployment rates (not seasonally adjusted) for September 2012 are:

- Colorado Springs--8.2%

- Denver-Aurora--3.0%

- Fort Collins-Loveland--0.5%

- Grand Junction--8.4%

- Greeley--1.4%

- Pueblo--1.5%

- Statewide--3.4%

Since mid-2009, The Fort Collins-Loveland area has consistently shown one of the lowest unemployment rates while Grand Junction and Pueblo have generally shown the highest rates.during recent months, however, The Colorado Springs are has moved into second place behind Pueblo for the highest unemployment rate while Grand Junction has fallen again. The Greeley area showed a big drop in its unemployment rate from 8.8 percent to 7.9 percent, year over year.

The unemployment rate decreased in all metro areas except Pueblo where the unemployment rate increased from 9.9 percent to 10.1 percent, year over year.

To provide some additional context, we can look to see how far below total employment levels are below the most recent peak in employment in each region. The peak time differs in each region. For example, the labor market peaked in mid-2007 in the Colorado Springs area, but it did not peak until late 2008 in the Grand Junction area.

The following numbers reflect how far below the most recent peak are the September 2012 employment totals:

- Colorado Springs MSA--8.8%

- Denver-Aurora MSA--3.6%

- Fort Collins-Loveland MSA--2.0%

- Grand Junction MSA--8.4%

- Greeley MSA--1.4%

- Pueblo MSA--3.1%

- Statewide--4.2%

All things being equal, the areas further below the peak have recovered the least from initial job losses. The noticeable exception is Pueblo where total employment is nearly back to peak levels, but the unemployment rate is being kept up by a growing labor force that is unable to find employment. Most other regions are experiencing very little growth in labor force, or even declines. See here for more on Pueblo.

For the first time since the recession, Colorado Springs is further below peak levels than all other metros, including Grand Junction. We see here also that the Ft. Collins-Loveland area has one of the strongest markets, with Greeley also moving toward peak levels.Northern Colorado continues to show signs of significant job growth.

(Note: If we include the Boulder-Longmont MSA, we find that the Boulder area has consistently been among the areas with the lowest unemployment rate. In September 2012, the rate in the Boulder-Longmont area was 5.7%.)